Article

Sports Tech M&A Landscape: Market Trends and Key Developments

SportsTechX · Friday, October 18th, 2024

Members Only

Join Now

Sign-in

Create a free account, or sign in below to gain access to this content.

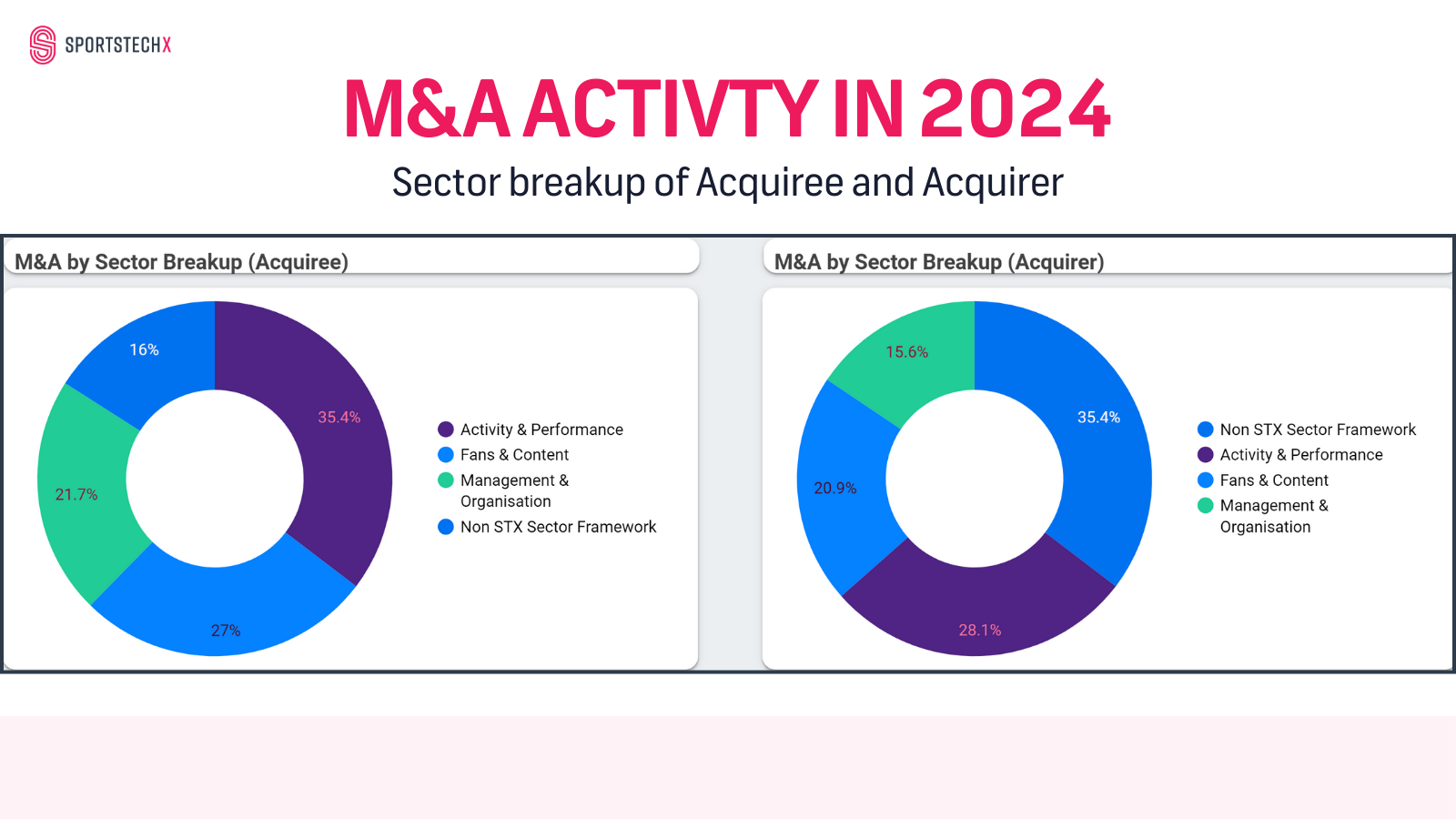

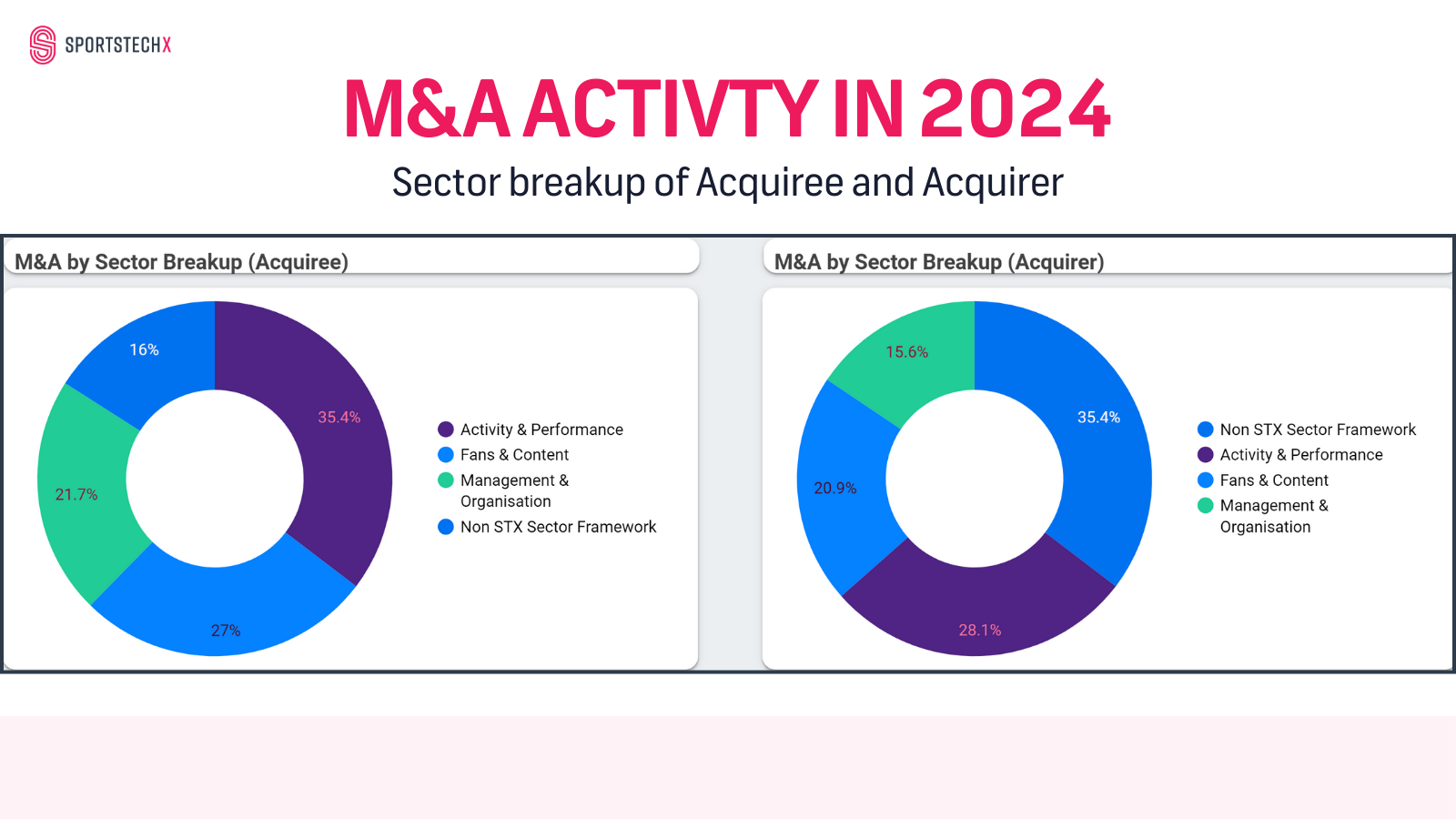

The sports tech M&A market in the last 5 years experienced fluctuations in both deal volume and transaction value. We called 2023 ‘The year of consolidation’, 2024 has seen more but nothing like last year. Total M&A deals in for the period 2020-2024 amounted to $26.3 billion across 263 transactions. The highest peak occurred in 2023, when the sector saw deals worth $10.9 billion, increasing consolidation across the industry. However, this momentum was tempered in 2024, with a $4.36 billion in disclosed deal values. Among the major transactions in the past year, noteworthy deals included: Snaitech (Italy) was acquired by...

Sign up

For our Newsletter

News, features & insights from the world of SportsTech. Every week.