Members Only

Join Now

Sign-in

Create a free account, or sign in below to gain access to this content.

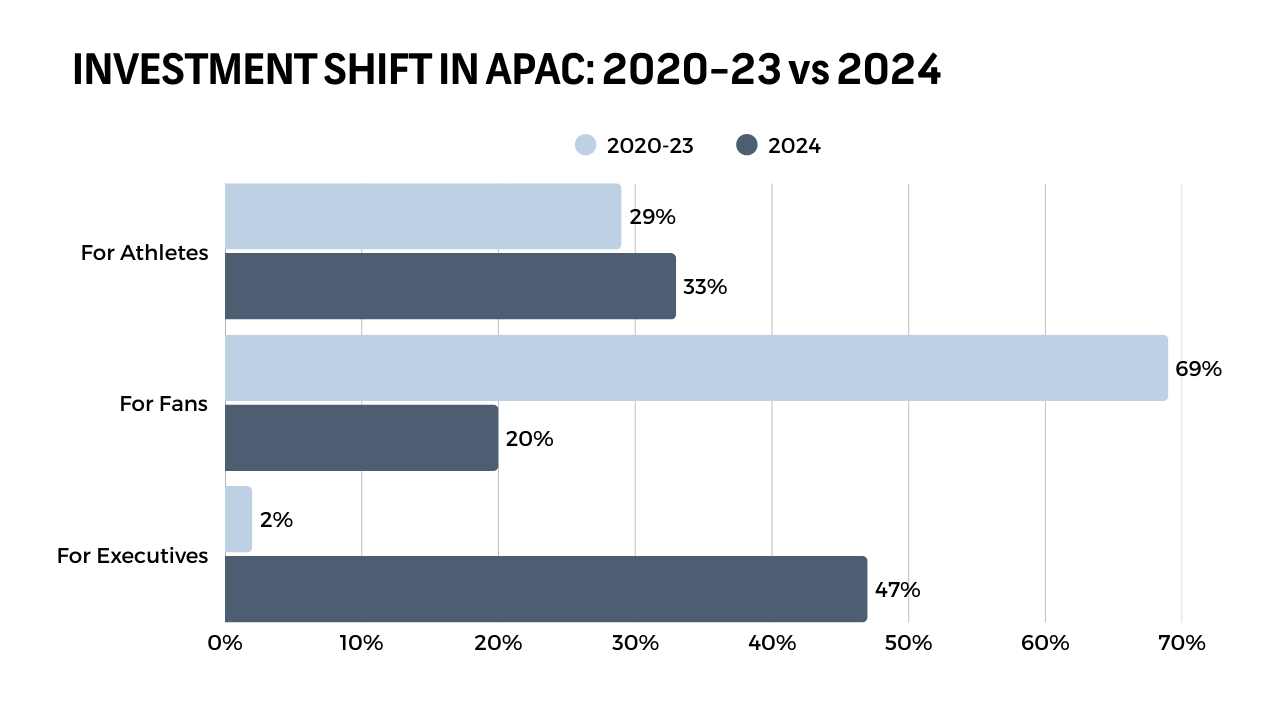

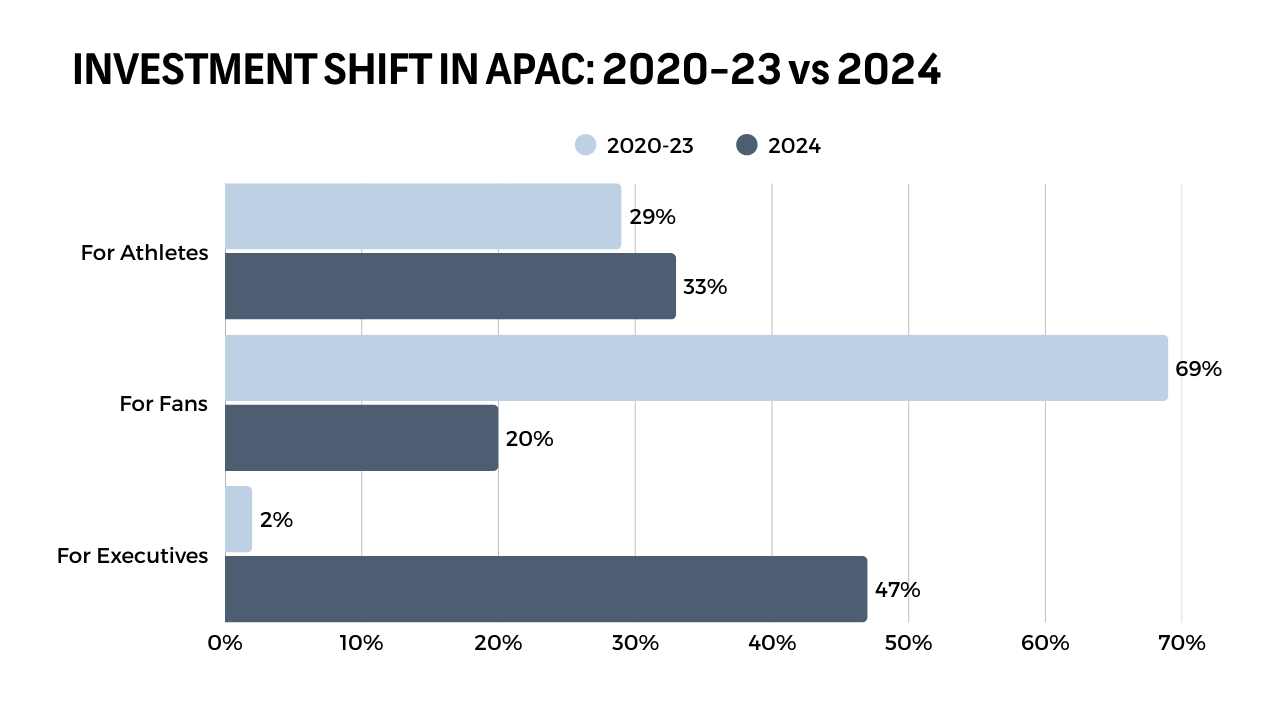

Over the past five years, the Asia-Pacific (APAC) region has quietly transformed into a serious contender in the global sports tech race. What's even more interesting is how APAC's investment priorities are evolving, signaling a strategically maturing ecosystem. $3.1 billion flowing into India and $2.2 billion into China alone. Regional Investment Landscape The APAC sports tech ecosystem has grown significantly, shifting away from its early dominance in Fans & Content technologies. In the last 5 years, these categories made up nearly 68% of the region’s funding, with fantasy sports, OTT platforms, and social media engagement tools attracting the most capital....

Sign up

For our Newsletter

News, features & insights from the world of SportsTech. Every week.